Automation Suited to a Modern-day Sterling Cooper

The client's mission is to provide premier business, management and technology consulting to clients with world-class skill and the personal touch of a local firm.

The Overview

Our client was spending an increasingly large amount of time each month preparing, proofing and issuing invoices. The resulting solution was centered upon Microsoft 365, the client’s enterprise collaboration suite, along with SQL Server and QuickBooks Online for enterprise data access and storage. Invoicing is now performed uniformly across all teams and clients while enabling firm partners to employ facts, data and automation to make invoicing decisions.

The

Challenge

Professional services firm invoicing can be surprisingly complex – clients often negotiate unique terms, projects sometimes involve one-off rates and practice partners typically review every issued invoice. Our client was spending an increasingly large amount of time each month preparing, proofing and issuing invoices. While a reduction in time was the primary driver, our client needed to maintain their central tenets to be fair to their clients and always present clear, accurate and uniform invoices to all clients. Any new system needed to utilize highly accurate enterprise data but also provide mechanisms for management and partner review.

The

Solution

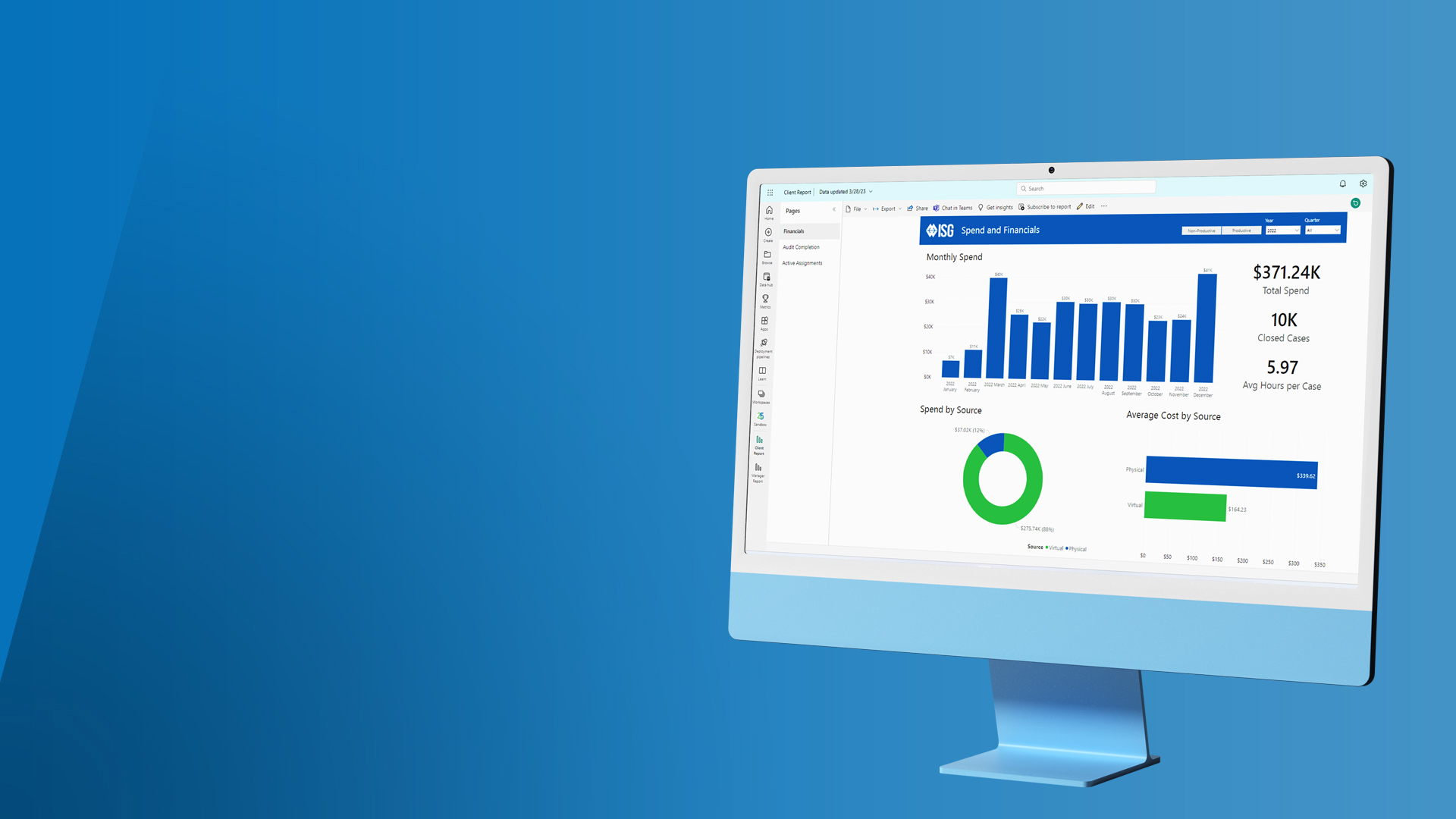

Our client engaged MercuryWorks to automate and streamline their monthly invoice creation and review process. The resulting solution was centered upon Microsoft 365, the client’s enterprise collaboration suite, along with SQL Server and QuickBooks Online for enterprise data access and storage. Notifications and real-time communication in Teams enables all stakeholders in each client account to clarify and refine accurate invoices.

The

Results

The new invoice automation process minimizes professional staff time spent performing invoicing functions and simultaneously reduced the firm’s Days Sales Outstanding. Invoicing is now performed uniformly across all teams and clients while enabling firm partners to employ facts, data and automation to make invoicing decisions. Having clear areas of responsibility at each step keeps all players involved aligned, reduces ramp-up time for new firm professionals and provides a clear view of cycle status at all times.

Dig In

App Features

Visualize

App Gallery

“MercuryWorks has been a delight to work with. We knew going into this that some sort of technology automation would be key, but we didn’t even contemplate the process review and rationalizing that we needed. We are nothing less than amazed at the improvement to our flow of business!”

Client

CFO

Behind The Curtain

Core Technology

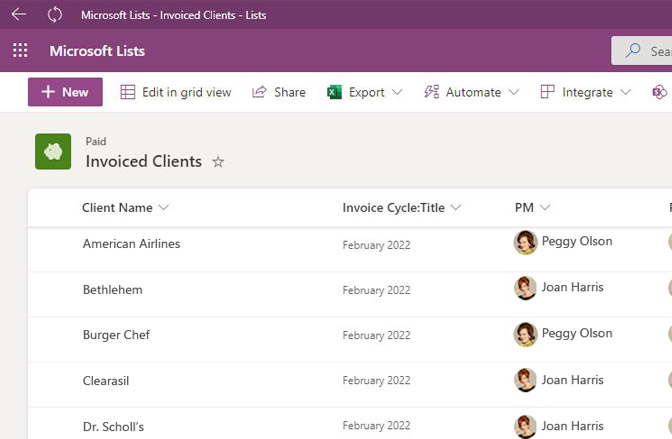

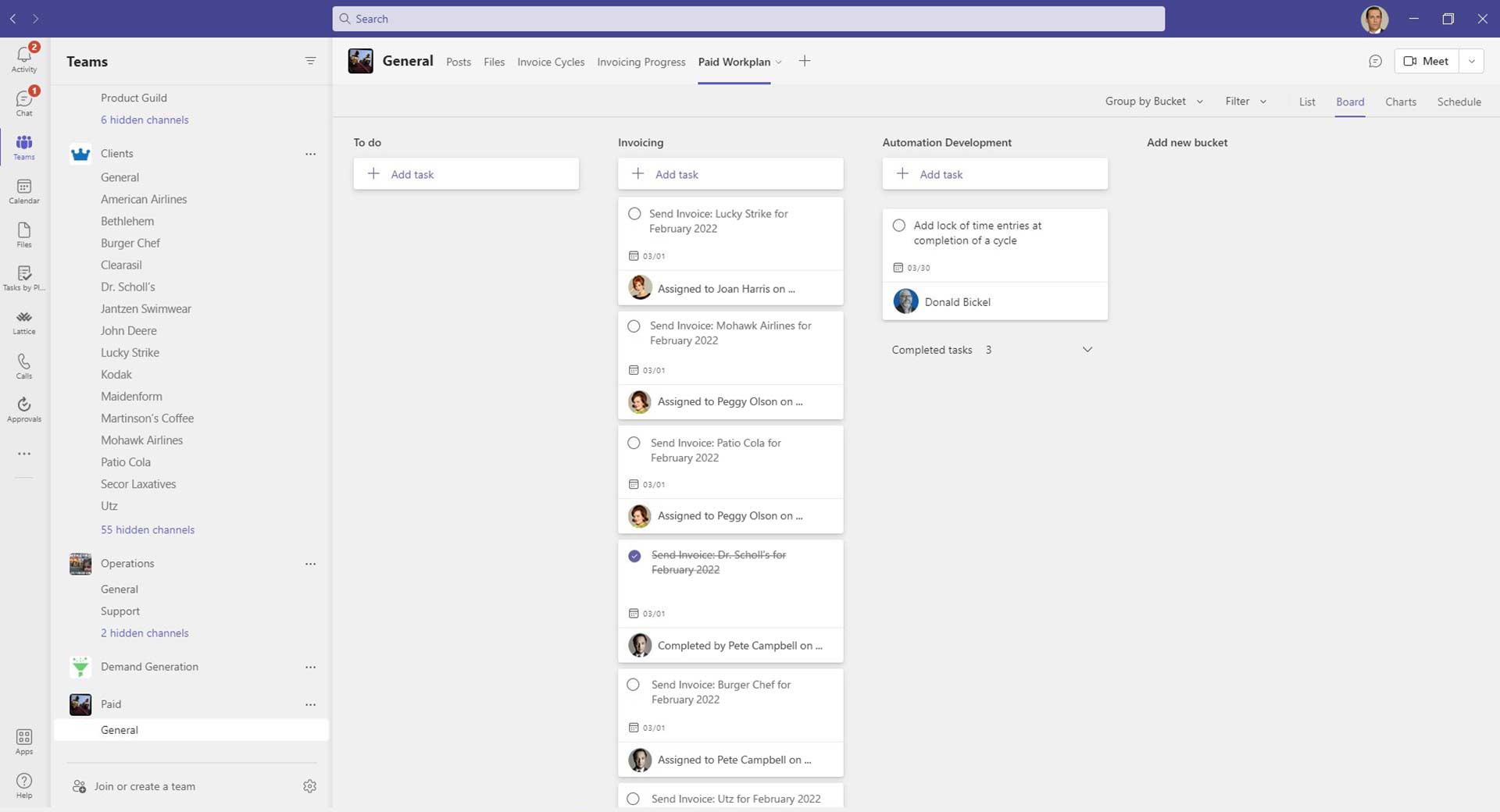

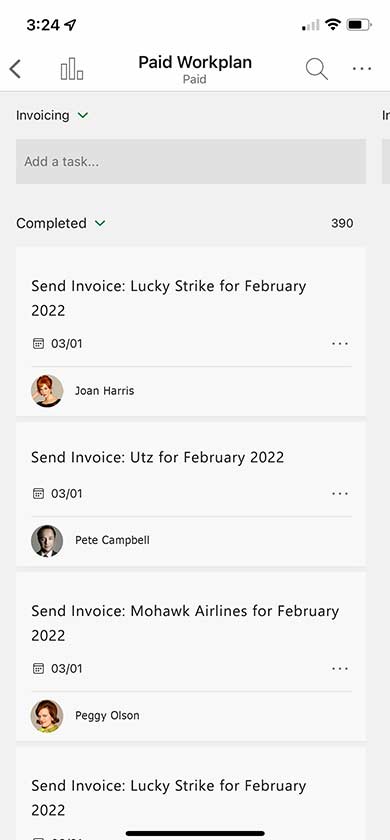

Microsoft Lists

Microsoft 365 provides the strength of modernized content publication, robust document libraries and data lists. Modern Microsoft Lists were used in this solution to provide business data storage while Planner provided a solid base for assignment tracking and notification.

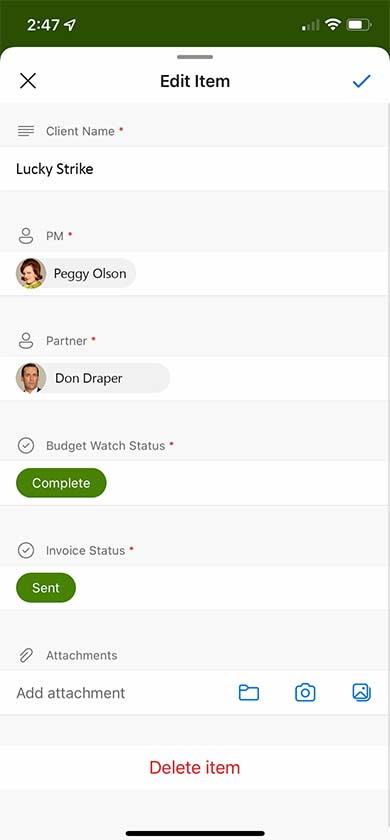

Power Apps

Surfaces data from myriad potential connected sources to provide a low-code application user interface. Power Apps was used as part of this solution to provide form rendering and user input screens.

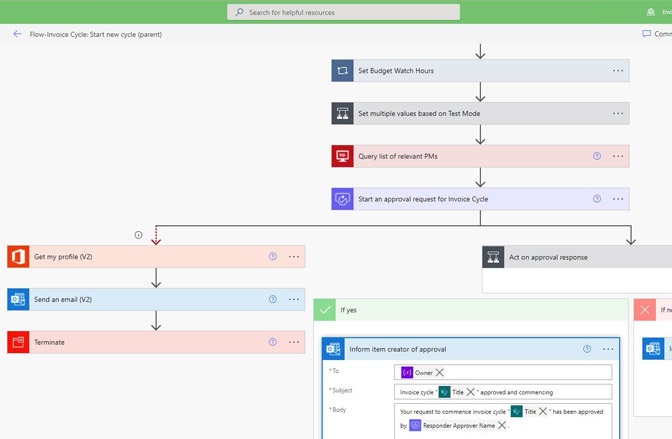

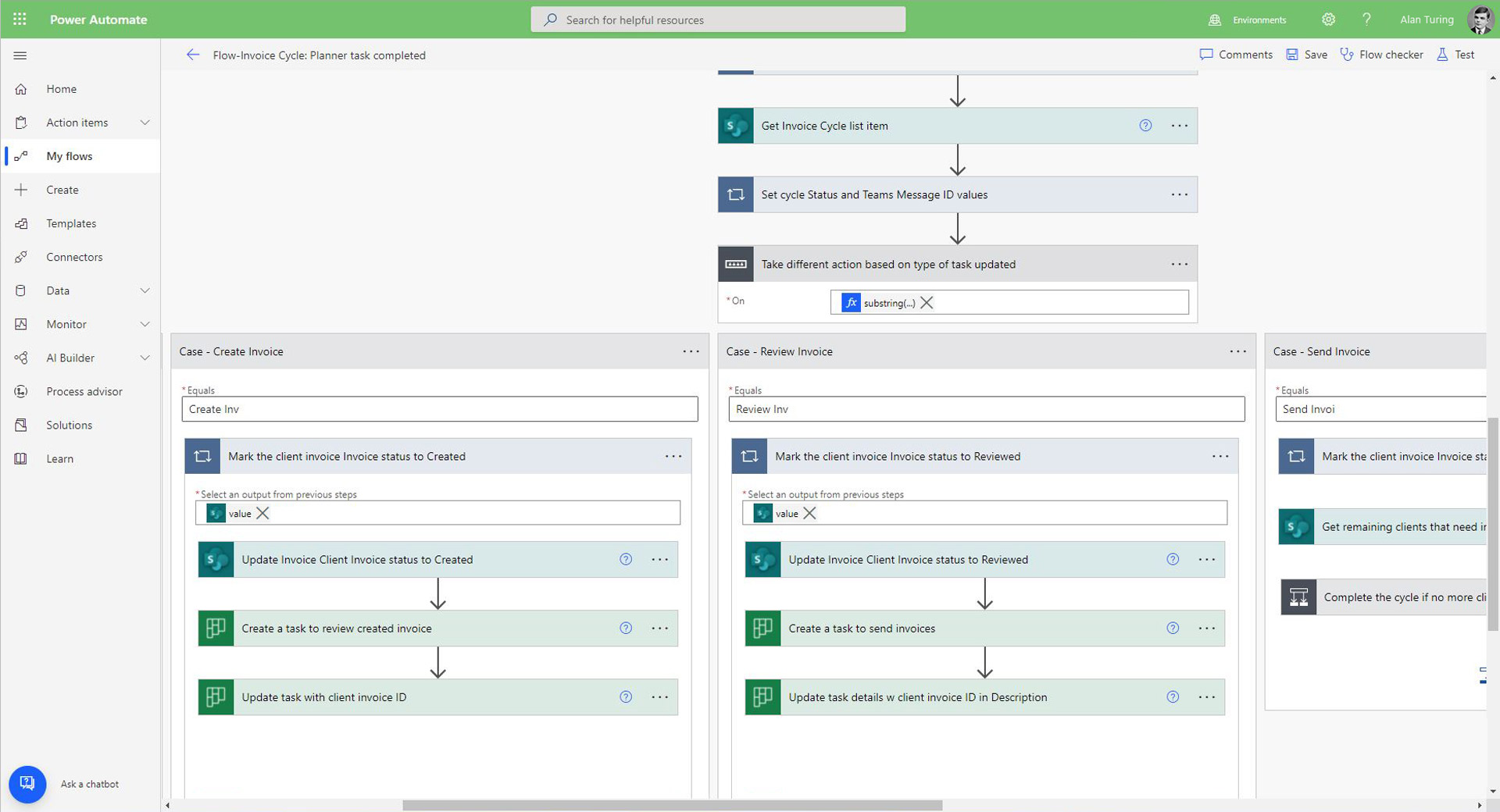

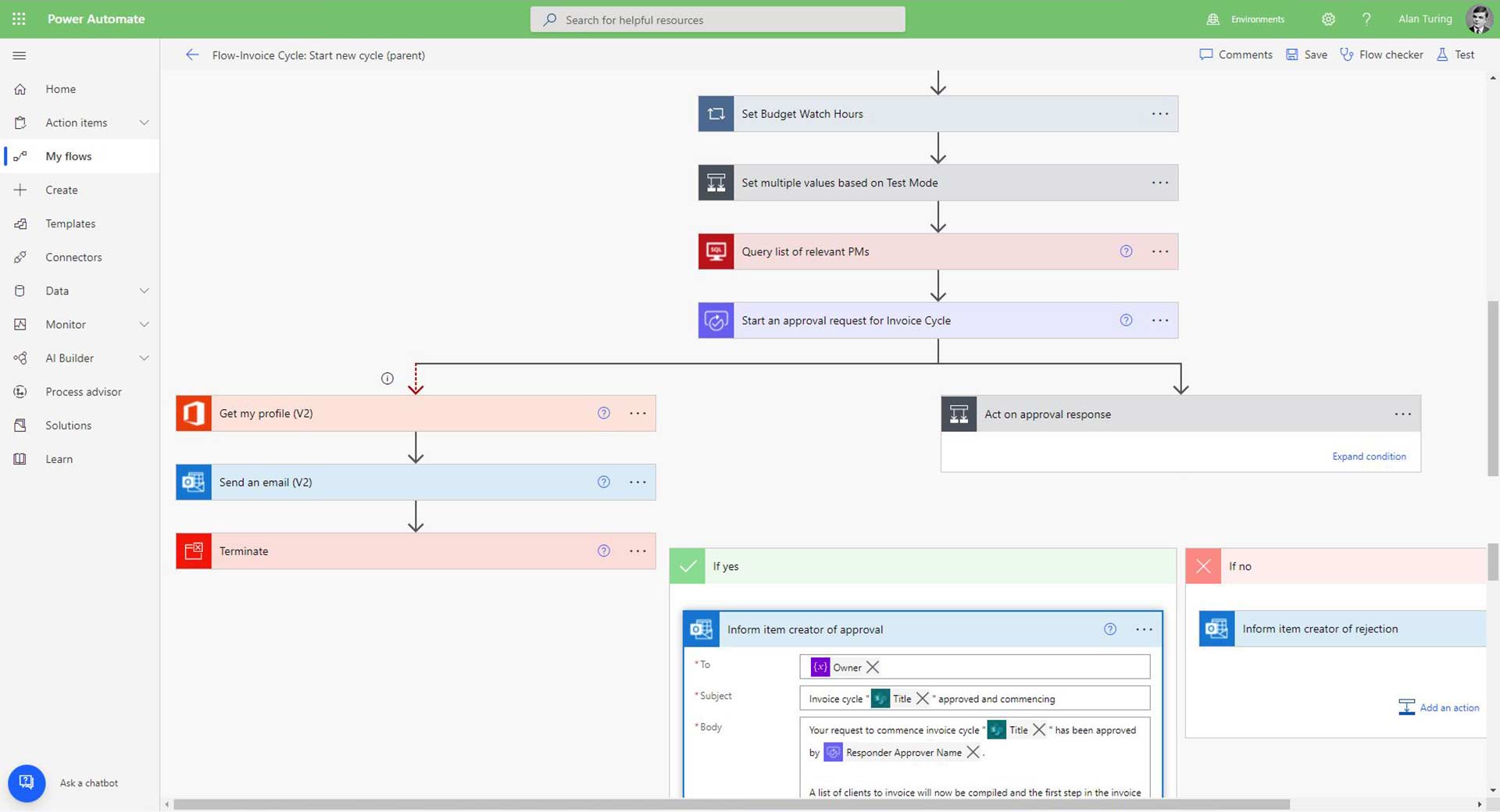

Power Automate

Provides logic, process flow and “behind the scenes” operations for cloud-based business solutions. Largely a no-/low-code solution, Power Automate puts the power of connected applications into knowledge workers’ hands.

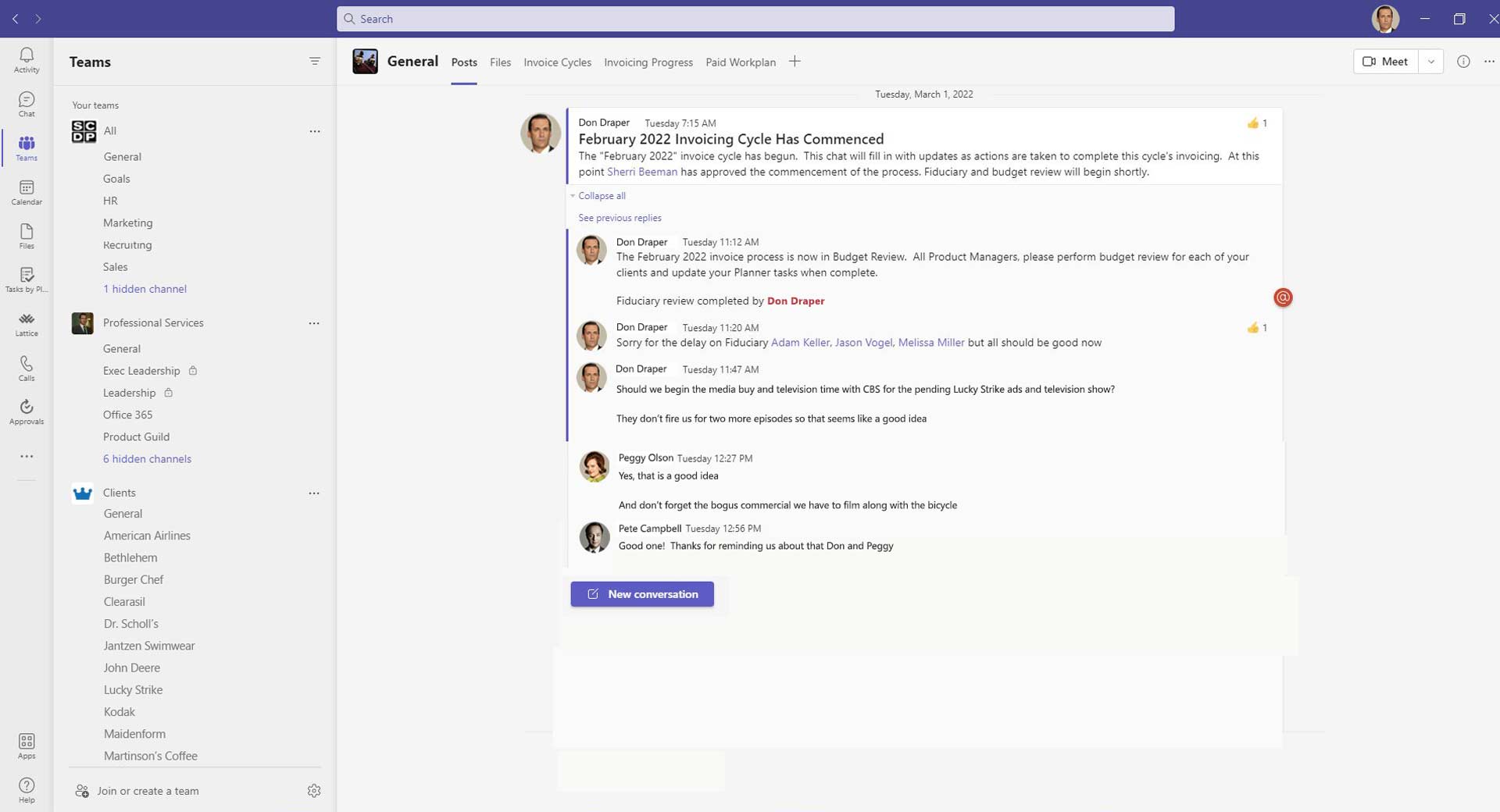

Teams

The collaboration glue of Microsoft 365, Teams was used as the collaborative space for business operations, data views and player communication during each automation cycle.

QuickBooks

The premier mid-sized business financial accounting system, utilized as the general ledger system and storage of firm financial information. Process automation integration via REST API enables the solution to register invoicing data in the client’s financial system of record.